As escalating health care costs force insurance rates to rise, many businesses are exploring ways to cut back on employee benefits. While eye care does cost more in your coverage plan, it doesn’t take 20/20 vision to see this is one area that is generally worth every cent.

Promoting good vision makes good sense, and quality eye care coverage is an important factor in keeping employees productive. In almost all cases, it also helps ensure their safety and well-being in the workplace.

There are more than 1,000 on-the-job eye injuries occurring daily, costing businesses more than $300 million a year in lost production time, medical expenses and worker’s compensation. The need for insurance coverage is further supported by the fact that more than 75 percent of Americans between the ages of 25 and 64 require some form of vision correction. What business can afford to have employee productivity and performance compromised by vision problems?

Detection

Also, keep in mind that regular eye exams can detect an array of serious illnesses, such as diabetes and high blood pressure, and may reduce healthcare and other costs associated with related sick time.

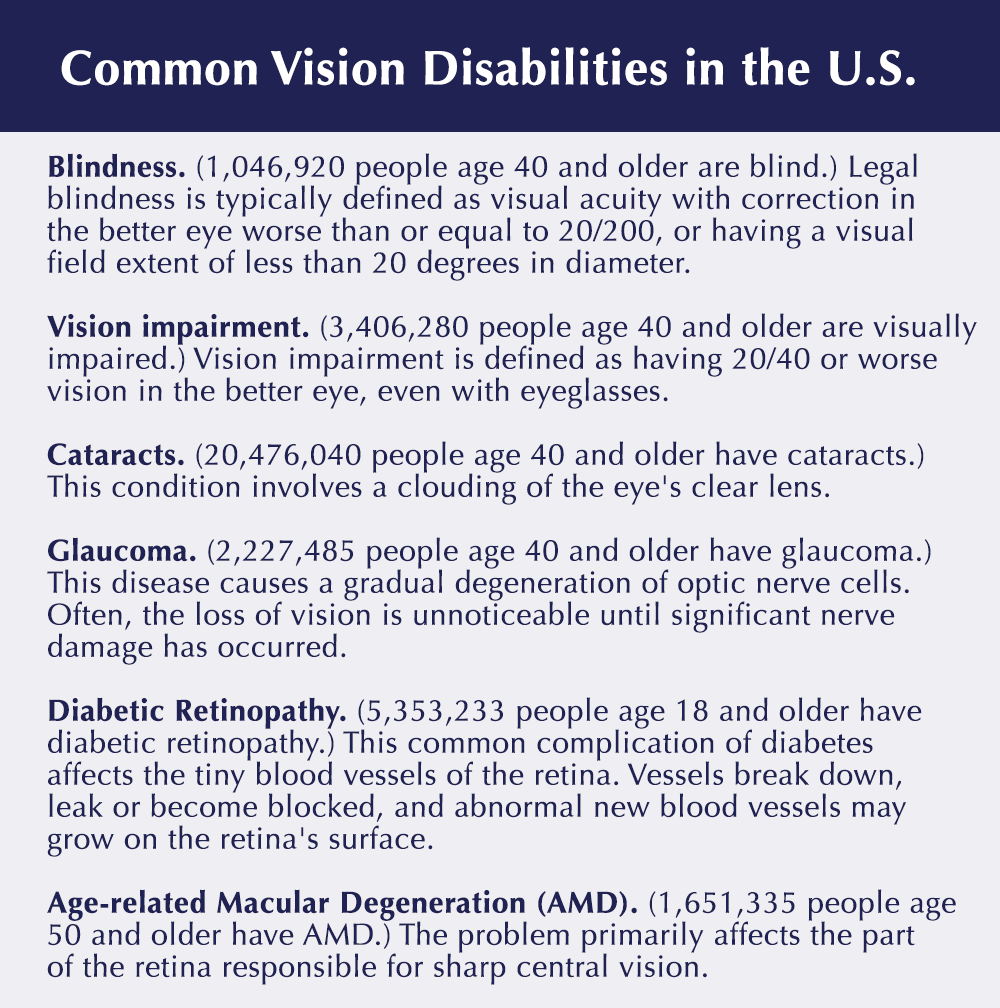

Furthermore, visual impairment is one of the 10 most frequent causes of disability in America. By offering quality eye care coverage, businesses can potentially save hundreds of thousands of dollars in the long run.

Just ask your employees how they feel about vision benefits and you’ll quickly understand the importance of offering quality eye care coverage. In fact, recent studies have shown that two-thirds of employees say they would trade a vacation day for quality eye care benefits.

Good vision makes for more satisfied employees and can enhance productivity. Conversely, vision problems have been proven to cause hardship in people’s daily lives.

Prevent such hardships for your employees with a comprehensive eye care coverage plan. With the right one, you should see a high return on your investment.

© Copyright 2019 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. Thomson Reuters and the Kinesis logo are trademarks of Thomson Reuters and its affiliated companies.

Disclaimer of Liability

Our firm provides the information in this e-newsletter for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this e-newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability and fitness for a particular purpose.

Blog

Nonprofit Insights