1. Choose to Deduct State and Local Sales Taxes

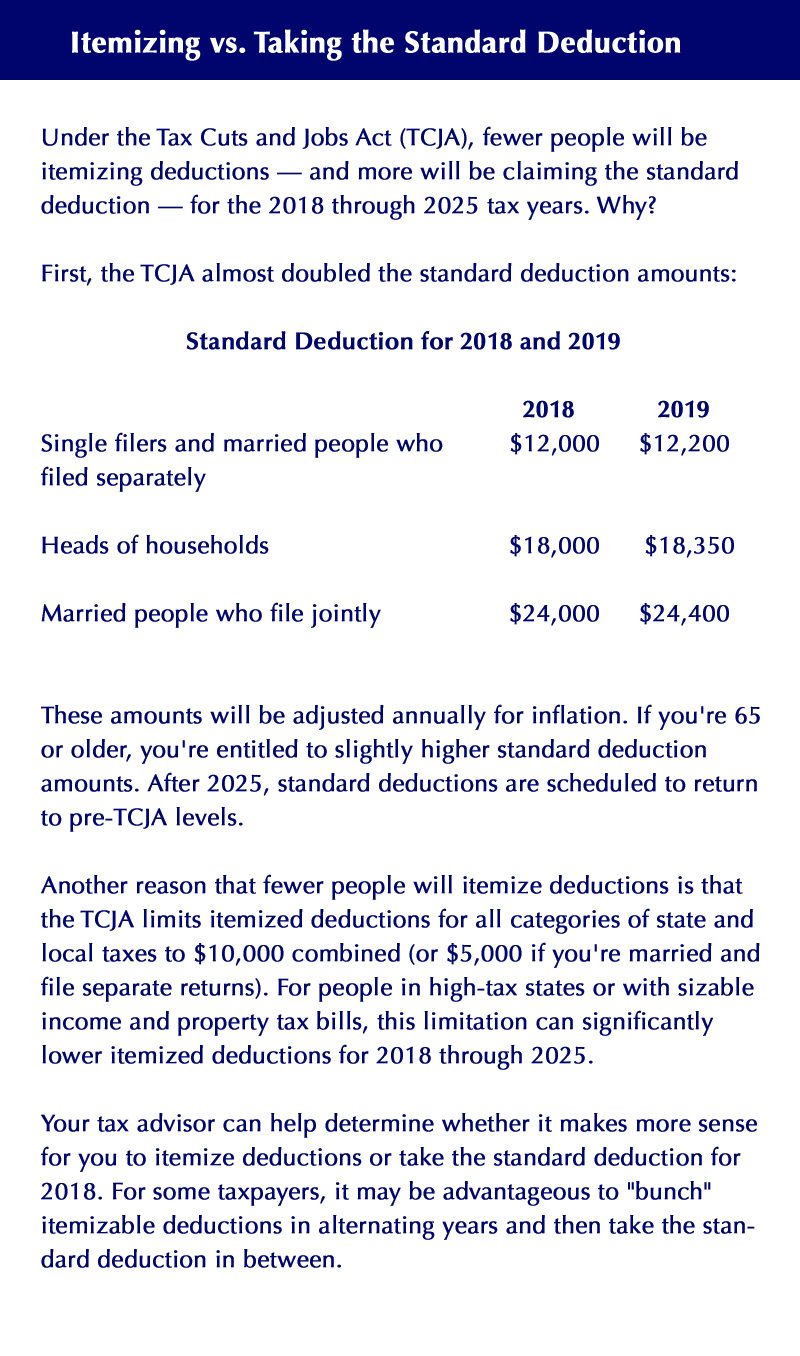

If you live in a jurisdiction with low or no personal income tax or you owe little or nothing to the state and local income tax collectors, you might consider deducting state sales taxes instead of state income taxes. However, this option only applies if you have enough itemized deductions to exceed your allowable standard deduction. (See “Itemizing vs. Taking the Standard Deduction” below.)

If you can benefit from choosing the sales tax option, you have two options to calculate your allowable sales tax deduction:

- Add up the actual sales tax amounts from 2018 receipts, or

- Use the amount from IRS tables based on your income, family size and state of residence.

- You can deduct the larger of these two amounts. But remember, your deduction for all state and local taxes (including property taxes and income or sales taxes) is limited to only $10,000 (or $5,000 for married people who file separate returns).

Important: If you use the IRS tables, you can add on actual sales tax amounts from major purchases. Examples include purchases of motor vehicles (including motorcycles, off-road vehicles and RVs), boats, aircraft and home improvements. In other words, you can deduct actual sales taxes for these major purchases on top of the predetermined amount from the IRS table.

2. Claim an Itemized Deduction for Medical Costs

If you itemize deductions for 2018, you can potentially claim a deduction for qualifying medical expenses, including premiums for private health insurance coverage and premiums for Medicare health insurance.

The catch is that your total qualifying medical expenses must exceed 7.5 percent of your adjusted gross income (AGI) for the 2018 tax year. For 2019, the deduction threshold is scheduled to rise to 10 percent of AGI unless Congress extends the 7.5 percent of AGI deal.

Key Point: If you’re self-employed or an S corporation shareholder-employee, you can probably claim an above-the-line deduction for your health insurance premiums, including Medicare premiums. In this case, you don’t need to itemize to get the tax-saving benefit of deducting health insurance premiums.

3. Make a Deductible HSA Contribution

If you had qualifying high-deductible health insurance coverage last year, you can make a deductible contribution to a Health Savings Account (HSA) of up to $3,450 for self-only coverage or up to $6,900 for family coverage. For 2018, a high-deductible policy is defined as one with a deductible of at least $1,350 for self-only coverage or $2,700 for family coverage.

If you’re eligible to make an HSA contribution for last year, the deadline to open an account and make a deductible contribution for your 2018 tax year is generally April 15, 2019. However, for taxpayers in Massachusetts and Maine, the deadline is April 17 due to holidays. (April 15 is Patriots’ Day in Maine and Massachusetts; April 16 is Emancipation Day in Washington, D.C., where the IRS is located.)

The write-off for HSA contributions is an above-the-line deduction. That means you can take it even if you don’t itemize. In addition, this privilege isn’t phased out based on your income level. Even billionaires can contribute to an HSA if they have qualifying high-deductible health insurance coverage and meet the other eligibility requirements.

4. Make a Deductible IRA Contribution

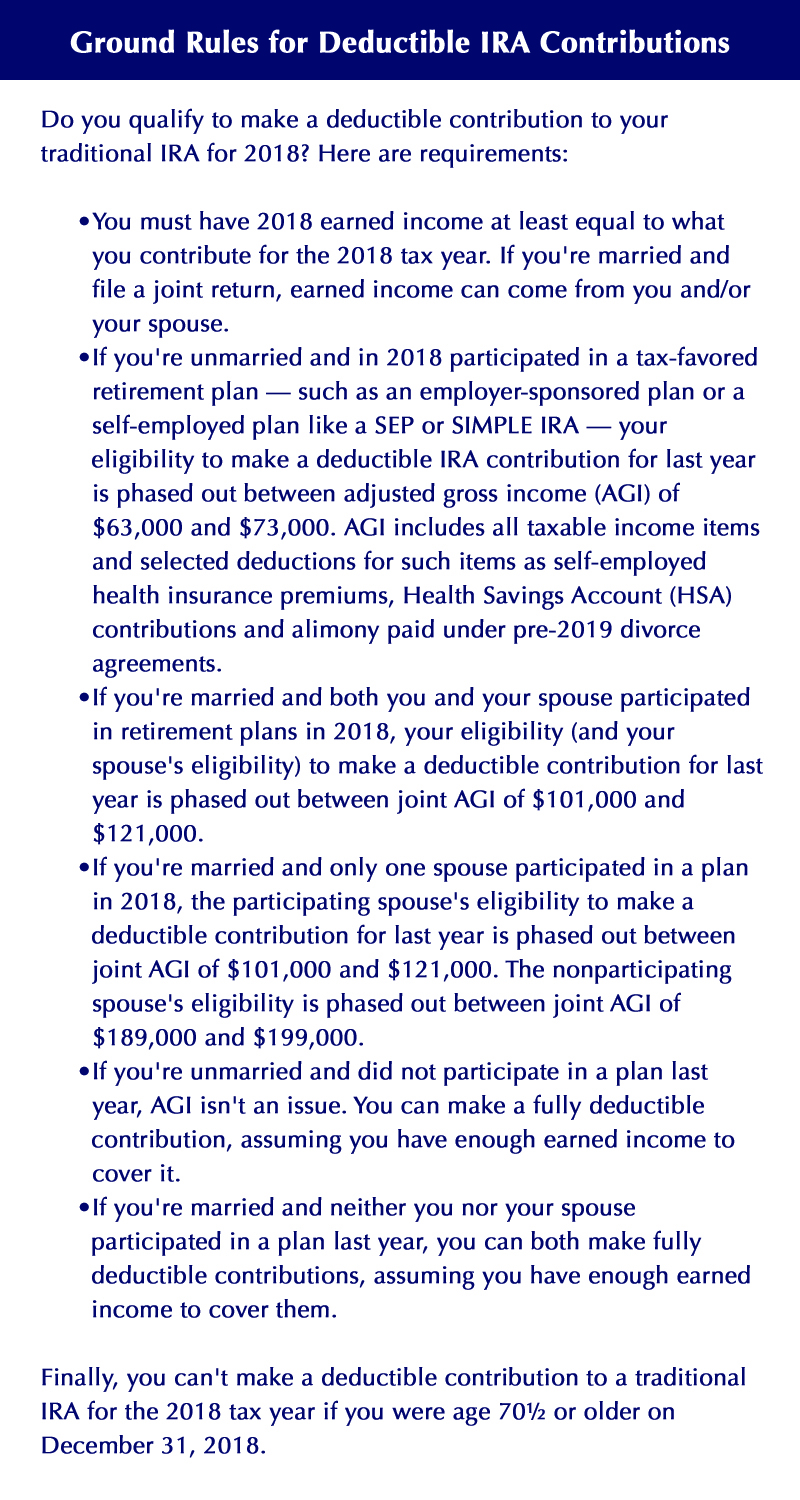

If you qualify and haven’t yet made a deductible traditional IRA contribution for the 2018 tax year, you can do so between now and April 15 and claim the resulting write-off on your 2018 return. Qualifying taxpayers can potentially make a deductible contribution of up to $5,500 or up to $6,500 if they’re 50 or older as of December 31, 2018. If you’re married, your spouse can also make a deductible IRA contribution.

However, there are a few caveats. You must have enough 2018 earned income to equal or exceed your IRA contributions for the tax year. If you’re married, either you or your spouse (or both) can provide the necessary earned income. In addition, deductible IRA contributions are phased out based on your income level and participation in tax-favored retirement plans last year. (See “Ground Rules for Deductible IRA Contributions” below.)

5. Make Charitable Donations from Your IRA to Replace Taxable Required Minimum Distributions (RMD)

After reaching age 70½, you can make cash donations to IRS-approved charities out of your IRA. These qualified charitable distributions (QCDs) aren’t like garden-variety charitable donations. You can’t claim itemized deductions for them, but that’s OK. The tax-free treatment of QCDs equates to a deduction, because you’ll never be taxed on those amounts.

If you inherited an IRA from a deceased original account owner and you’re at least 70½, you can use the QCD strategy with the inherited account, too.

There’s a $100,000 limit on total QCDs each year. But if you and your spouse both have IRAs set up in your respective names, each of you is entitled to a separate $100,000 annual QCD limit.

QCDs taken from traditional IRAs count as distributions for purposes of the RMD rules. Therefore, you can arrange to donate all or part of your annual RMD amount (up to the $100,000 limit) that you would otherwise be forced to receive and pay taxes on.

There’s still time to implement the QCD strategy for the 2018 tax year if you turned 70½ last year and haven’t yet taken your initial IRA RMD. You have until April 1 of the year after you turn 70½ to take your first RMD. If you miss the April 1 deadline, you’ll face a 50 percent penalty on any shortfall.

Important: If you take your first RMD on or before April 1, 2019, you also must take another RMD for the 2019 tax year by December 31 of this year. In this situation, not taking advantage of the QCD option to fulfill your 2018 and 2019 RMD obligations would mean having to take two taxable RMDs this year. However, if you use the QCD strategy, you can replace those taxable RMDs with tax-free QCDs.

Act Fast

These are some of the more widely available last-minute tax-saving maneuvers that you should consider before Tax Day. Contact us to determine whether these or any other last-minute strategies might work for your specific situation, 434.296.2156 or info@hwllp.cpa.

© Copyright 2019 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. Thomson Reuters and the Kinesis logo are trademarks of Thomson Reuters and its affiliated companies.

Disclaimer of Liability

Our firm provides the information in this e-newsletter for general guidance only and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this e-newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

Blog

Nonprofit Insights