Most businesses will owe less tax for the 2018 tax year than they would have under prior law, thanks to changes brought by the Tax Cuts and Jobs Act (TCJA). But have you done everything possible to lower your business tax bill for last year? Even though 2018 is in your review mirror, there are some possibilities for business owners to consider if your return for the last tax year hasn’t been prepared yet.

New QBI Deduction for Pass-Through Entities

Before the TCJA, net taxable income from so-called “pass-through” business entities was simply passed through to you as an individual owner and taxed at your personal rates. This includes sole proprietorships, partnerships, limited liability companies (LLCs) treated as sole proprietorships or partnerships for tax purposes and S corporations.

For tax years beginning in 2018, the TCJA allows a new deduction for individual owners of pass-through entities based on their share of qualified business income (QBI) from those entities. The deduction can be up to 20 percent of QBI, subject to restrictions that can apply at higher owner income levels.

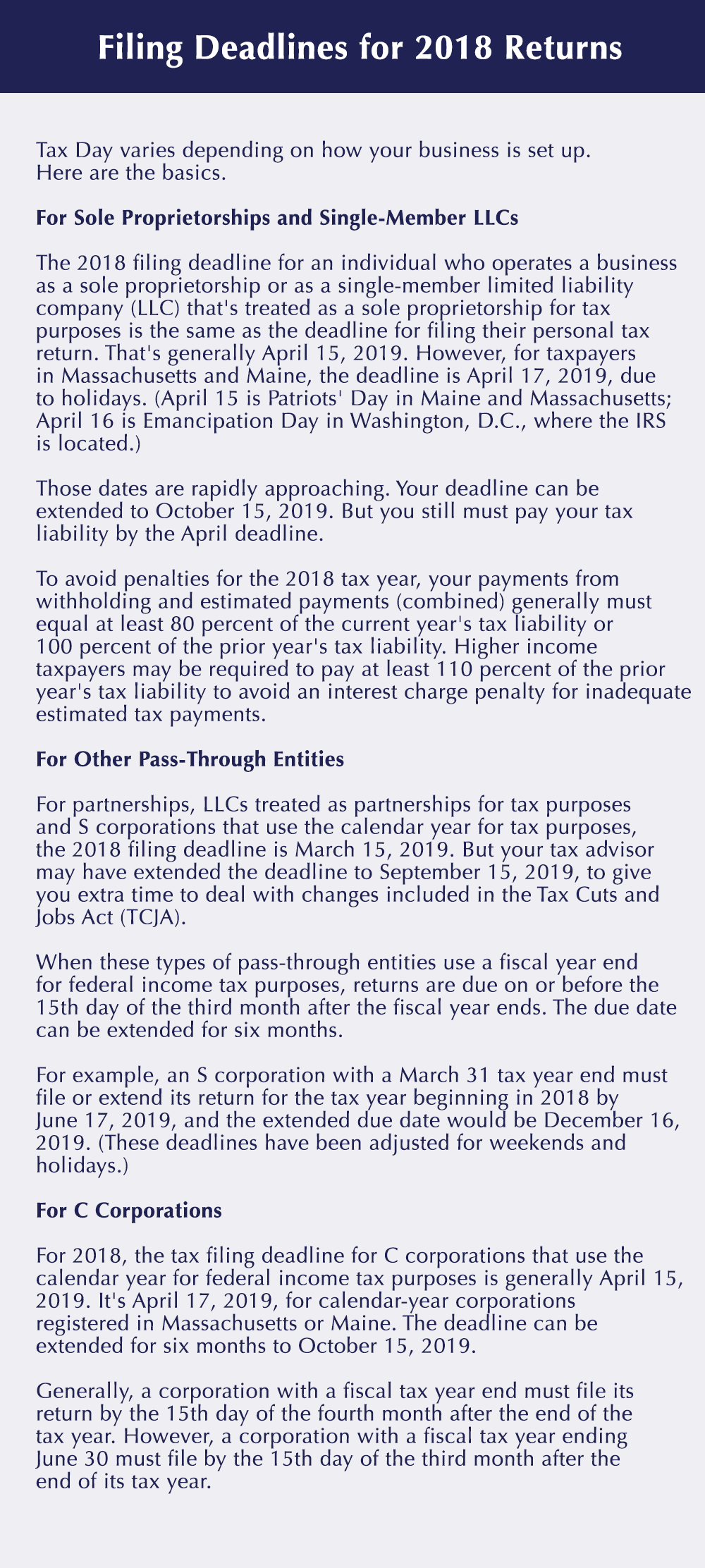

If you qualify, the deduction is claimed on your personal tax return. (See “Filing Deadlines for 2018 Returns” below.) The IRS has issued regulations on how to calculate the QBI deduction, but they’re lengthy and complex. So, it’s important to discuss the details with your tax advisor.

100 Percent First-Year Bonus Depreciation

Under the bonus depreciation program, businesses are allowed to deduct 100 percent of the cost of certain assets in the first year, rather than capitalize them on their balance sheets and gradually depreciate them. This break applies to qualifying assets placed in service between September 28, 2017, and December 31, 2022 (or by December 31, 2023, for certain assets with longer production periods and for aircraft). After that, the bonus depreciation percentage is reduced by 20 percent per year, until it’s fully phased out after 2026 (or after 2027 for certain assets with longer production periods and for aircraft).

Bonus depreciation is allowed for both new and used qualifying assets, which include most categories of tangible depreciable assets other than real estate. This change will be a major tax-saving benefit on many 2018 business returns, including returns for sole proprietors and owners of pass-through entities.

Expanded Section 179 First-Year Depreciation Deductions

For qualifying assets (including expenditures for certain building improvements) placed in service in tax years beginning in 2018, the TCJA increased the maximum Section 179 first-year depreciation deduction to $1 million (up from $510,000 for 2017). The TCJA also expanded the definition of qualifying assets to include depreciable tangible personal property used mainly in the furnishing of lodging (such as furniture and appliances).

The definition of qualifying real property eligible for the Sec. 179 deduction was also expanded to include eligible expenditures for nonresidential real property:

- Roofs,

- HVAC equipment,

- Fire protection systems and

- Alarm and security systems.

These favorable Sec. 179 deduction changes will deliver tax-saving benefits on many 2018 business returns, including returns for sole proprietors and owners of pass-through entities. However, the deduction is subject to several limitations.

Important: When both 100 percent first-year bonus depreciation and the Sec. 179 deduction privilege are available for the same asset, it’s generally more advantageous to claim 100 percent bonus depreciation, because there are no limitations on that break.

Generous Depreciation Deductions for Passenger Vehicles Used for Business

For new or used passenger vehicles that were placed in service in 2018 and used over 50 percent for business, the maximum annual depreciation deductions allowed under the TCJA are as follows:

- $10,000 for 2018 (or $18,000 if you claim first-year bonus depreciation),

- $16,000 for 2019,

- $9,600 for 2020 and

- $5,760 for 2021 and thereafter until the vehicle is fully depreciated.

Under prior law, the 2017 limits for passenger cars were as follows:

- $11,160 for the first year for a new car (or $3,160 for a used car),

- $5,100 for the second year,

- $3,050 for the third year and

- $1,875 for the fourth year and thereafter.

Slightly higher limits applied to light trucks and light vans. So, the TCJA limits are much more taxpayer friendly.

Favorable New Tax Accounting Rules

Starting with tax years beginning in 2018, the new tax law increases the gross receipts limit to $25 million for eligible C corporations and partnerships that want to:

- Elect the cash method of accounting (rather than the accrual method),

- Elect out of the requirement to use the percentage-of-completion method to report income from long-term construction contracts,

- Elect simplified alternatives for inventory accounting or

- Avoid the complex uniform capitalization (UNICAP) rules that generally require producers and resellers of real and personal property to include in inventory direct costs and certain indirect costs.

The $25 million gross receipts limit will be adjusted annually for inflation after 2018. Whether it’s advantageous to use these accounting alternatives depends on your business situation — and there’s more to consider than just taxes.

For example, the cash basis method of accounting generally defers income recognition for tax purposes and allows greater tax-planning flexibility. However, the accrual method conforms to U.S. Generally Accepted Accounting Principles (GAAP) and, therefore, facilitates M&A due diligence and comparisons with public companies.

Deductions for Business-Related Meals

Under prior law, you could generally deduct 50 percent of business-related entertainment expenses. For amounts incurred in 2018 and beyond, the TCJA generally disallows deductions for business-related entertainment.

However, meal expenses incurred in connection with business entertainment (for example, meals at sporting events) and meal expenses to wine and dine customers, clients and prospects are still 50 percent deductible. Be sure receipts from vendors separate the costs of meals from the total bill, rather than providing just a combined total.

SEP Plans

If you own a small business and haven’t yet set up a tax-favored retirement plan for yourself, you can establish a simplified employee pension (SEP). Unlike other types of small business retirement plans, a SEP can be created this year and still generate a deduction on last year’s return.

In fact, if you’re self-employed and extend your calendar-year 2018 personal tax return, you’ll have until October 15, 2019, to take care of the paperwork and make a deductible contribution for last year. The deductible contribution can be up to:

- 20 percent of your 2018 self-employment income or

- 25 percent of your 2018 salary if you work for your own corporation.

The absolute maximum amount you can contribute for the 2018 tax year is $55,000.

Important: You may not want a SEP if your business has employees, because you might have to cover them and make contributions to their accounts. That could be cost prohibitive.

What’s Right for Your Business?

This article covers some widely available options for your 2018 business tax return. Call or email us to see if there are other things to consider, 434.296.2156 or info@hwllp.cpa.

© Copyright 2019 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. Thomson Reuters and the Kinesis logo are trademarks of Thomson Reuters and its affiliated companies.

Disclaimer of Liability

Our firm provides the information in this e-newsletter for general guidance only and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this e-newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

Blog

Nonprofit Insights