If you are nearing full retirement age (FRA), you have probably been asking yourself if you should wait until age 70 to claim social security.

If you decide to take “early” retirement and claim benefits before you reach your FRA, your benefit is reduced since it is assumed you will receive more payments than those who wait until FRA to retire. If you claim early retirement and continue to work, some of your benefits may be held back until you reach your FRA.

If you decide to delay claiming your social security benefits beyond your FRA, your benefit is increased 8% per year of delay. But note, this increase in benefits ceases at age 70. Once you reach age 70, there is no benefit to delaying claiming your benefits.

When deciding whether to claim your benefits at your FRA or delay them, there are a variety of factors to consider.

Lifestyle

A couple questions worth considering in determining when to claim benefits include, “Can I afford to wait for those benefits?” and, “Do I have sufficient other sources of income and investments to support the lifestyle I want?”

Taxes

For Federal income tax purposes, up to 85% of your social security benefits may be taxable. Delaying your benefits could save you taxes in the short term.

Spouse

For those who are married to a spouse who also qualifies for benefits, it may make sense for one spouse to begin benefits at FRA and the other spouse to delay until age 70. If there is an expectation that the higher earnings spouse will die before the other, it makes sense for that higher earning spouse to delay benefits as long as possible to increase the spousal social security benefit for a widow/widower.

Personal Health

Another factor to consider is your health. It may make sense to claim your benefits at FRA (or earlier) in order to do things you may not be able to do in the future, such as travel. Though it may not be a comfortable consideration, look at your family history of longevity. This can be a clue to your own longevity.

Reminder: Be sure to enroll in Medicare when you turn age 65 regardless of when you claim social security benefits. Failure to do so could result in much higher Medicare premiums over your lifetime. Enrollment can be delayed if you are still employed; talk with your employer’s human resources department.

Next Steps

Deciding the right time to claim social security can be difficult to determine, but you do not have to do it alone. Contact a member of our advisory team to help.

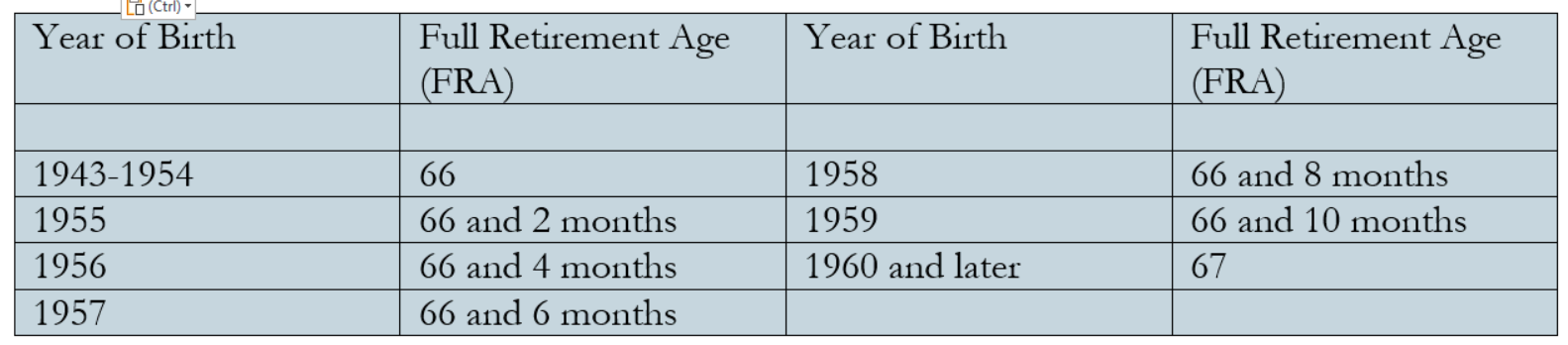

Full Retirement Age Reference Chart

Contact Us

Disclaimer of Liability

Our firm provides the information in this article for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this blog are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability and fitness for a particular purpose.

Blog

Nonprofit Insights